Stonewell Bookkeeping Can Be Fun For Anyone

Wiki Article

The smart Trick of Stonewell Bookkeeping That Nobody is Talking About

Table of ContentsEverything about Stonewell BookkeepingNot known Details About Stonewell Bookkeeping The smart Trick of Stonewell Bookkeeping That Nobody is DiscussingAll about Stonewell BookkeepingThe 4-Minute Rule for Stonewell Bookkeeping

Here, we respond to the question, how does accounting assist an organization? Real state of a firm's financial resources and money flow is always in flux. In a sense, accountancy publications represent a picture in time, however only if they are upgraded frequently. If a company is absorbing bit, an owner must act to raise revenue.

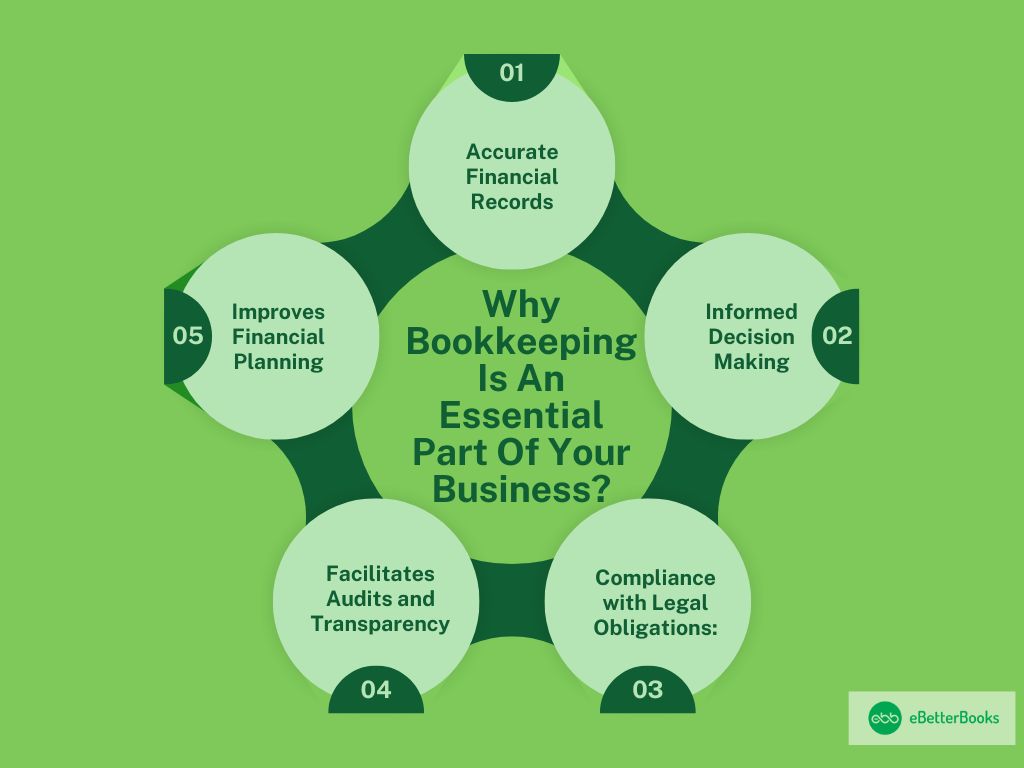

None of these final thoughts are made in a vacuum as accurate numerical information need to buttress the economic decisions of every little business. Such information is assembled with accounting.

You know the funds that are readily available and where they drop short. The news is not constantly excellent, but at least you recognize it.

Fascination About Stonewell Bookkeeping

The puzzle of reductions, credits, exceptions, schedules, and, naturally, fines, suffices to simply give up to the IRS, without a body of efficient documentation to sustain your claims. This is why a devoted accountant is vital to a small company and deserves his or her weight in gold.

Your service return makes insurance claims and representations and the audit targets at confirming them (https://www.pubpub.org/user/stonewell-bookkeeping). Excellent bookkeeping is all regarding attaching the dots in between those representations and reality (franchise opportunities). When auditors can follow the information on a ledger to receipts, bank statements, and pay stubs, to name a few records, they rapidly learn of the proficiency and stability of business organization

A Biased View of Stonewell Bookkeeping

In the very same means, haphazard accounting includes in stress and anxiousness, it also blinds local business owner's to the prospective they can recognize over time. Without the info to see where you are, you are hard-pressed to set a location. Only with reasonable, in-depth, and accurate data can a company owner or administration team plot a program for future success.Service proprietors know ideal whether an accountant, accounting professional, or both, is the right service. Both make crucial payments to a company, though they are not the exact same profession. Whereas an accountant can collect and arrange the info required to sustain tax obligation prep work, an accounting professional is much better fit to prepare the return itself and really evaluate the revenue statement.

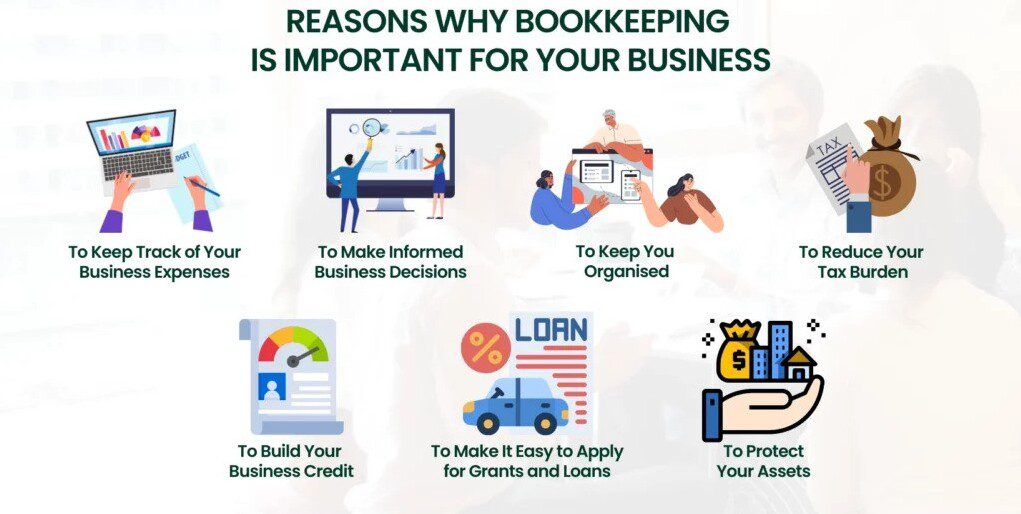

This write-up browse around this web-site will certainly dig right into the, consisting of the and exactly how it can profit your business. Accounting entails recording and organizing monetary transactions, including sales, acquisitions, repayments, and receipts.

This write-up browse around this web-site will certainly dig right into the, consisting of the and exactly how it can profit your business. Accounting entails recording and organizing monetary transactions, including sales, acquisitions, repayments, and receipts.By consistently updating monetary documents, bookkeeping aids organizations. This assists in easily r and conserves companies from the stress of looking for files throughout target dates.

Stonewell Bookkeeping Things To Know Before You Get This

They are primarily concerned regarding whether their cash has been made use of effectively or not. They absolutely want to understand if the business is making money or otherwise. They likewise need to know what possibility the business has. These elements can be conveniently handled with accounting. The revenue and loss statement, which is prepared routinely, shows the revenues and also figures out the potential based upon the earnings.Therefore, accounting aids to prevent the problems connected with reporting to financiers. By keeping a close eye on monetary records, services can establish practical goals and track their development. This, consequently, promotes much better decision-making and faster company growth. Government guidelines usually call for companies to maintain financial records. Regular accounting makes sure that services stay compliant and prevent any fines or lawful problems.

Single-entry bookkeeping is straightforward and functions finest for small businesses with few deals. It does not track possessions and responsibilities, making it less thorough compared to double-entry bookkeeping.

All about Stonewell Bookkeeping

This can be daily, weekly, or monthly, depending on your organization's size and the volume of deals. Do not think twice to seek assistance from an accounting professional or bookkeeper if you find managing your financial records challenging. If you are looking for a free walkthrough with the Audit Service by KPI, call us today.Report this wiki page